Rising construction costs and ongoing labour shortages are putting increasing pressure on builders and new home buyers, according to the latest Herron Todd White (HTW) Month in Review.

In the May report, National Director, Residential, Ben Esau said builders are now facing rising interest rates to go along with higher costs which will put even more pressure on margins.

“Demand for new dwellings and renovations spiked through the pandemic which, in turn, put pressure on the cost of building,” Mr Esau said.

“But increases in construction costs have been driven primarily by the lack of supply surrounding core materials and labour – it’s unlikely rate rises will remedy this.”

Mr Esau said builders had previously been able to simply raise prices, but now rising costs and higher interest rates are starting to see demand fall.

“When costs rose during the pandemic, builders had to increase their quotes to protect their margins,” he said.

“Simply increasing contract prices may not be as effective when it comes to interest rate rises.

First home buyers are still benefiting from a range of government incentives and are still likely to be active in the market according to Mr Esau.

“Rising interest rates could do little to stymie first homeowners from building,” he said.

“There are several existing grants helping this cohort into new builds, and the tightening rental market makes ownership rather than renting a compelling option.”

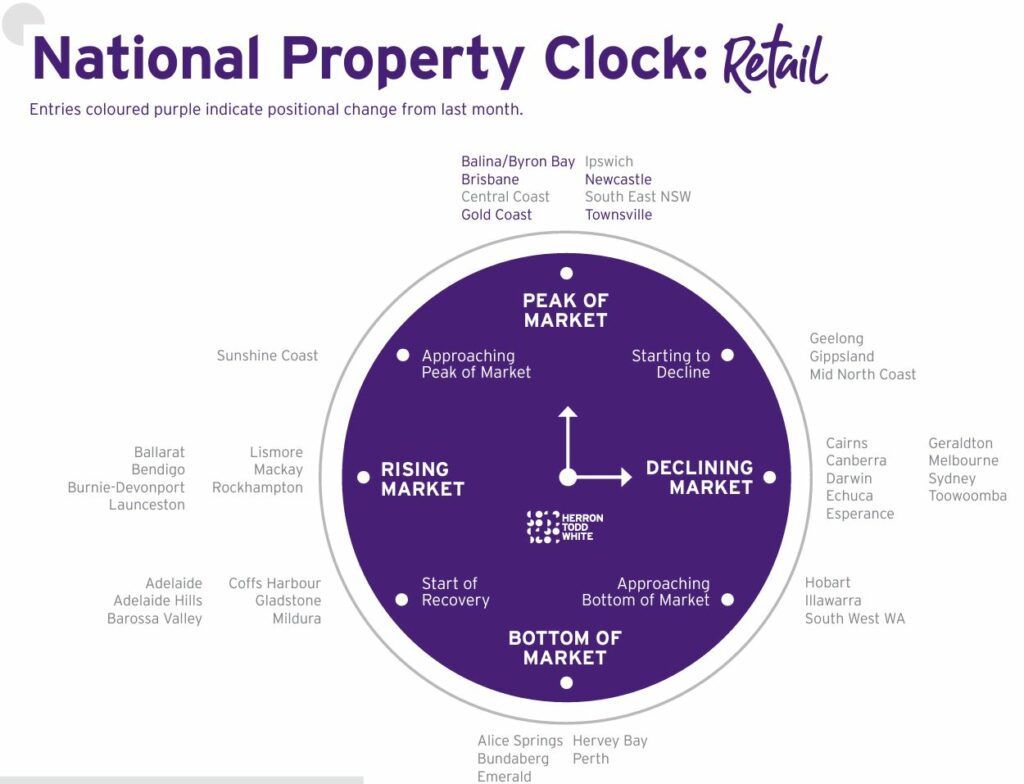

Commercial Director Vanessa Hoey said higher construction costs and the fallout from lockdowns were also having an impact on the retail sector.

“There is limited new construction of major shopping centres planned throughout Australia in 2022, however many retail landlords are seeking to redevelop or expand their properties to include the addition of other uses such as medical, childcare, office and residential,” Ms Hoey said.

“Some landlords with available funds took advantage of the lockdowns throughout 2020 and 2021 to undertake refurbishments or repurposing for alternative uses and are now benefitting from being able to attract quality tenants relatively quickly.”

Sydney

New South Wales residential construction costs have increased by 8.8 per cent in the past 12 months according to CoreLogic.

HTW Director Shaun Thomas said labour shortages and demand for building work was making it harder for smaller projects.

“The real problem is seen in those undertaking small renovations or repairs,” Mr Thomas said.

“Delays can be months and work can be very slow as tradespeople are drawn towards the bigger jobs of building a home which comes with financial certainty and stability compared to one-off renovations.

“Given the increased costs in construction and the delays in completing a renovation – with renovations taking longer than 12 months in some instances – newly renovated dwellings appear to be achieving a premium in recent months.”

HTW Director Scott Russell said new retail construction had been fairly limited in Sydney.

“The built-up nature of the inner-city areas mean that there are few opportunities to expand or develop,” Mr Russell said.

“New retail construction has been typically limited to new housing estates in the outer western suburbs which promise residents new shopping centres and retail hubs to service these newly developed estates.”

Melbourne

HTW Director Perron King said an increase in new builds and renovations along with supply chain disruptions and a shortage of materials had resulted in an unprecedented spike in construction costs across Melbourne.

“The surge in dwelling approvals, which peaked last year, has progressed through to construction, causing a strong demand for materials and trades,” Mr King said.

“With many existing off-the-plan apartment sale contracts in place, builders and developers have found it difficult to generate profit as material and construction costs rise with no signs of slowing down.”

HTW Valuer Nathanial Ramage said significant refurbishment projects of retail properties within the wider Melbourne area had been taking place to attract higher quality tenants.

“We are seeing these works being undertaken both exclusively by landlords and in conjunction with incoming tenants who are completing significant works and sharing the costs with landlords,” Mr Ramage said.

Brisbane

Property values across Brisbane continue to perform strongly while demand for construction is incredibly high.

HTW Director David Notley said there’s the hangover of the construction boom that got underway in 2021.

“Government assistance designed to ramp up the industry during the pandemic’s economic struggles saw plenty of owners look to complete a build or refurbish their current homes,” Mr Notley said.

“As a result, all contractors have been in hot demand.

“Whether it be new builds or renovations, demand is high and supply is limited for builders, materials, fittings and fixtures.

“We’ve heard anecdotally that builders are now prioritising larger jobs because they’re more profitable than smaller renovations or rectifications.”

HTW Associate Director Edward Cox said the supply of new retail property has slowed as construction costs have risen.

“New builds in our market are definitely showing signs of slowing down with developers concerned about the increase in construction costs which flows on to the feasibility of a project, given that yields are showing signs of stabilising (i.e. are at peak of the market or not far off) and with real growth in rents, that feasibility is being squeezed,” Mr Cox said.

“That said, demand is still strong and supply is limited.

“Large format retail and shopping centres are experiencing more refurbishment activity compared to their smaller regional counterparts.”

Adelaide

HTW Nick Smerdon Director said construction times across Adelaide have blown out due to ongoing shortages.

“Historically, building timeframes have been six to eight months from contract signing to handing over of the keys,” Mr Smerdon said.

“These timeframes have increased to 10 months or greater with some builders reporting delays of up to 18 months.

“The majority of construction is occurring within the large estates at the extremities of the greater metropolitan area.”

HTW Commercial Director Chris Winter said the South Australian retail property market is seeing significant retail construction and refurbishment in Adelaide.

“The return on investment for these refurbishments and redevelopments is still enticing, with South Australia continuing to offer higher yields than the eastern seaboard,” Mr Winter said.

Perth

HTW Director Chris Hinchliffe said ongoing labour shortages have been amplified by vaccine mandates and closed borders, leaving the construction sector facing challenges like never before.

“We are witnessing delays across the whole of Western Australia with building companies waiting months for essential building materials,” Mr Hinchliffe said.

“Gone are the days when you could build 100 square metres for less than $200,000 pre-pandemic; this is also likely to set you back at least 25 per cent more than what you would’ve typically paid pre-pandemic.

“First home buyer suburbs are seeing increasing demand for brand new or newer built dwellings and are experiencing sale prices higher than anticipated.”

HTW Director Greg Lamborn said retail construction had been heavily impacted heavily by government restrictions with most activity limited to certain areas.

“Construction of new retail space has been prevalent in designated activity centres in Perth’s establishing, peripheral suburbs,” Mr Lamborn said.

“Typically, these projects consist of neighbourhood-sized shopping centres anchored by a major supermarket.”

Darwin

HTW Residential Property Valuer Tom Dickinson said skilled labour shortages had been evident for some time now and have stretched the construction industry’s ability to deliver housing on budget and on time.

“The rise in construction costs being felt across the whole of the Northern Territory is the combined result of many demand and supply factors within Australia and the international market, Mr Dickinson said.

“With so many of the major materials that go into building a house increasing in price, many consumers are now having to wear the increases as construction companies can no longer absorb cost increases within their margins.

“To overcome this, we are seeing build contracts being rewritten or changed to simplify designs to make them more cost effective.”

ACT

HTW Assistant Property Valuer Tahleah Williams said the demand for construction remains high, with extended wait times for construction start dates and completion dates.

“Build rates start at $2000 to $2500 per square metre for very basic standard project homes in the ACT,” Ms Williams said.

“Basic terrace homes show higher rates, sitting at around $4000 per square metre plus.”