Challenging market conditions, including rising costs and falling commissions, have weighed on real estate businesses, according to a new report.

Macquarie Business Banking’s 2023 Real Estate Benchmarking Report, which surveyed 431 residential real estate agencies across Australia, found that in the 2023 financial year agency revenues declined 6 per cent, while profitability fell 11 per cent.

Macquarie Business Banking, National Head of Real Estate, Domonic Thompson said the 2023 financial year was challenging for real estate agents, with declines in revenue and profitability, due to operating costs outpacing revenue gains.

“While real estate agents have seen their revenue heavily influenced by external factors, profit margins and performance remain within relative control, through cost management, efficiency and productivity monitoring,” Mr Thompson said.

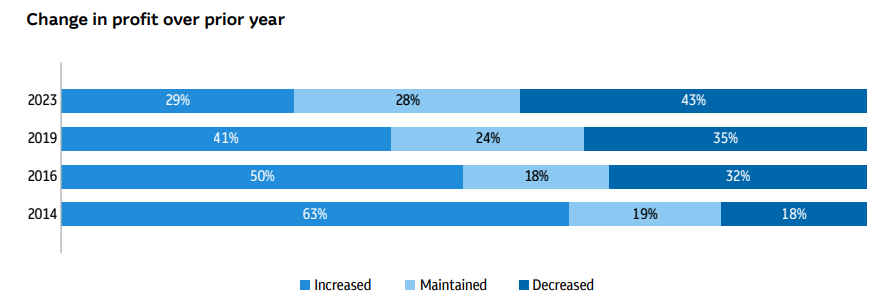

“Overall, we’ve seen the industry experience ongoing margin pressure, which has impacted sales and property management commissions, with 71 per cent of respondents recording flat or declining net profit margins in the 2023 financial year, and an increasing number of businesses reported declining year-on-year profitability since 2014.”

Mr Thompson said price discounting and competition was identified by 43 per cent of respondents as a key challenge, while staff costs (63 per cent) and operating costs (57 per cent) were the key reasons for a decline in profitability during the 2023 financial year.

The report found that in 2009, commissions averaged 2.5 per cent, but by 2023, that number had fallen to 1.95 per cent.

While property management commissions had dropped from 7.3 per cent in 2014 to 6.7 per cent in 2023.

The report found that the biggest contributor to costs has been staffing, with salaries and sales commissions accounting for 62 per cent of overall expenses and 49 per cent of revenue.

Agency owners need to focus attention on productivity and efficiency, to ensure that these costs are returned in value, the report said.

Macquarie also said that as margins come under pressure, commission splits with sales agents can add additional strain to agency revenues, especially if negotiated in more favourable environments.

With rising transactional values masking margin pressures in recent years, revenues must be paired with associated costs, monitored, and managed carefully they said.

Mr Thompson said despite the challenging market conditions, the industry remains robust, with real estate businesses with property management offerings providing a key focus area and driver of competition in mergers and acquisitions.

“Property management portfolios continue to be a focus for growth and scale, which is being bolstered by acquisitions,” he said.

“With 80 per cent of agencies focused on property management growth, the key to success will be to shift away from price driven competition towards offering holistic value, nurturing existing client relationships, as well as future buyers, vendors and property managers.”

The report found that the number of properties under management increased to 872 per agency in 2023, up from 375 in 2009.

It said that property management commissions had not decreased at the same rate as sales commissions, but were symptomatic of difficulty articulating value to clients, and competition for listings.

While the downward trend in property management commissions needs to reverse for businesses to maintain profits.

Mr Thompson said amid market pressures, the real estate industry also faced the challenge of retaining key staff, as well as attracting new talent.

“With one-in-four people changing roles over the past 12 months, coupled with increased wages and operating costs, the industry is at a critical point, where agencies need to address staff challenges by building trust and respect,” he said.

“Getting the people and culture balance can help differentiate an agency, drive better financial outcomes and enhance business value.”

He said nationally, 25 per cent of all agency staff were reported to have changed employers in the 2023 financial year, with property management the most impacted, with 35 per cent of property managers changing employers.

“What we’re seeing is business owners needing to adjust business structures to run more efficiently in the current climate, or even taking a more active role in the business to prepare for anticipated economic headwinds, reduce associated staffing costs or optimise chances of success in securing property listings,” he said.

Mr Thompson said the past few years had seen many real estate agencies delay succession due to the peaks and troughs of market cycles, coupled with a transitioning economy and pandemic measures.

“With merger and acquisition activity deferred through the pandemic period and market volatility, we saw an increase in business sale, exit and succession activity in 2022, however in our view the challenge for many is navigating a highly competitive landscape to transact,” he said.

“More than half (55 per cent) of real estate business owners are considering succession or reduction of operational involvement in their agency, and the key to understanding and maximising business value includes improving business performance, supporting staff with strong processes and systems, offering opportunities to develop and grow within the business and communicating a strong client value proposition.”