House prices in Sydney, Adelaide and Perth could have fully recovered from the 2022 downturn and reached new record highs by the end of the 2023-2024 financial year.

That’s the forecast from Domain, which today released its projections for the 12 months from July 1.

The 2022 downturn was the steepest Sydney had ever experienced, with house prices falling 9.6 per cent from peak to trough, but the recovery is expected to be steady in comparison.

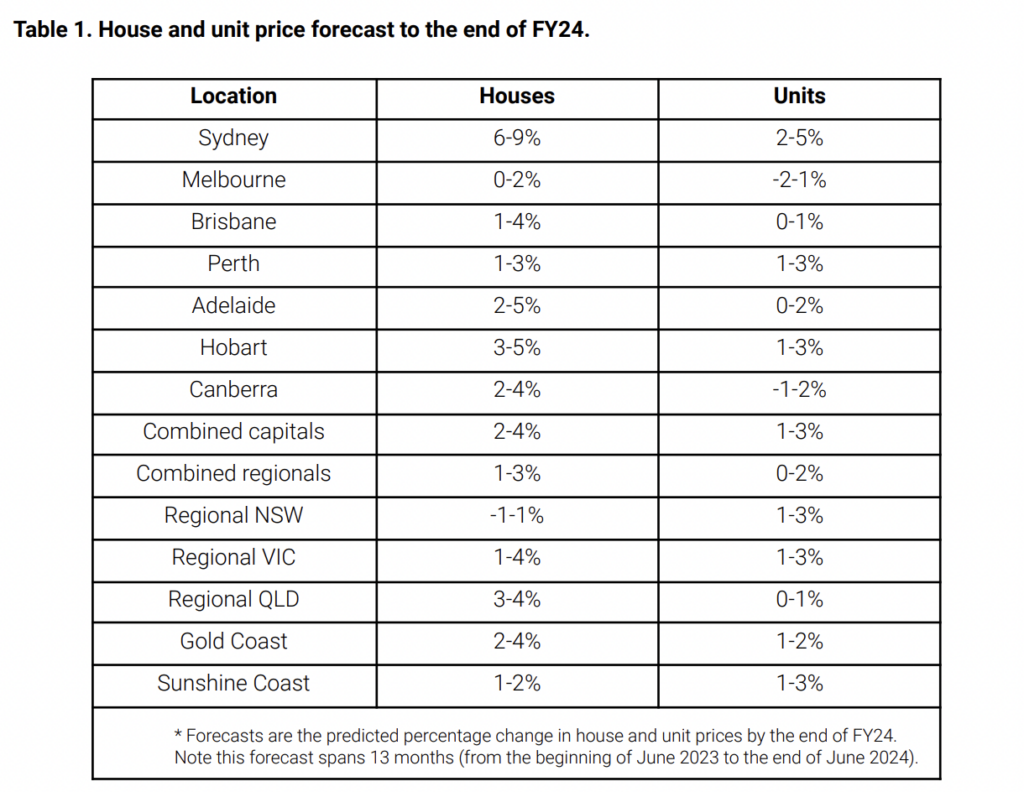

House prices in Sydney are tipped to rise between 6 per cent and 9 per cent, and growth in this range would see the median price land between $1.62 million and $1.66 million.

The previous record was $1.59 million in March 2022.

In Adelaide, house prices are forecast to rise between 2 per cent and 5 per cent, with a median price of between $837,000 and $861,000.

So far the city has avoided a price downturn such as Sydney and Melbourne have seen, and if the predicted growth eventuates, it will be the first time Adelaide house prices rise above $800,000.

Perth house prices will also hit new heights at the end of next financial year if forecast growth of between 1 per cent and 3 per cent becomes reality.

This growth would see the median house price in the Western Australian capital surpass $700,000 for the first time.

A new median house price of between $704,000 and $718,000 is tipped.

Domain Chief of Research and Economics Dr Nicola Powell said they were uniquely positioned to provide a “robust forecast” based upon economic indicators and its unique data insights.

She said population pressures would drive housing demand and property prices higher, especially with the momentum in lifting temporary and permanent visa grants to alleviate skills shortages.

“Population pressures will lead the charge in factors driving housing demand and property prices higher over the next 12 months,” Dr Powell said.

“Australia has seen an exponential increase in temporary and permanent migration since the international border reopened in late 2021 to alleviate skills shortages.

“Of course, unlike natural population growth, those arriving from overseas aren’t already housed.

“This puts us in a position where in the next financial year alone, nearly 130,000 extra dwellings will be needed, with the Eastern Seaboard receiving the largest share of migrants.”

House prices are also forecast to rise between 3 and 5 per cent in Hobart, followed by Canberra (2-4 per cent), Brisbane (1-4 per cent) and Melbourne (0-2 per cent).

House prices in the combined regionals are tipped to rise between 1 per cent and 3 per cent.

Dr Powell said along with the population increase, “unprecedented headwinds” in the construction industry and “unseasonably weak” listings would also drive up competition and prices.

“While prices are expected to rise, affordability will contain the pace of growth, as the likes of rapidly rising interest rates and ongoing mortgage serviceability challenges continue to play out in a complex and dynamic market,” she said.

Unit prices are also expected to rise in the next financial year, with Sydney set to climb between 2 and 5 per cent.

In Perth and Hobart, unit prices are forecast to jump between 1 and 3 per cent, followed by Adelaide (0-2 per cent) and Brisbane (0-1 per cent).

Unit prices in Melbourne and Canberra are tipped to fall.

Other factors influencing prices include buyers’ borrowing power, with rapidly rising interest rates and serviceability buffers resulting in significant capacity shrinkage.

This could mean some buyers can no longer afford to buy or push demand to the more affordable end of the market.

The “refinancing cliff”, with up to 880,000 Australian households rolling from fixed to variable interest rates near the start of the 2023-2024 financial year, could also have a significant impact.

So far, Domain data shows distressed listings remain low, at 2.8 per cent across the combined capitals and 2.7 per cent across the combined regionals, which is well below the 2018 high of 5.1 per cent for the combined capitals and 5.7 per cent for the combined regionals.